Calculate and submit your VAT Return

Summary

Description

If you've registered for MTD, and you've switched on MTD VAT submissions in your program, you can submit your VAT Return.

TIP: Need to submit a group VAT Return? With the Sage MTD Submissions Module, you can combine values from different companies to submit under one return.

TIP: Need to submit a group VAT Return? With the Sage MTD Submissions Module, you can combine values from different companies to submit under one return.

Resolution

If you're using the MTD Submissions Module, only follow the first two sections below to calculate your VAT Return for each company in Sage.

Summary of steps

- Calculate and reconcile your VAT Return

- Post the VAT transfer journal

- Submit your VAT return to HRMC

Calculate and reconcile your VAT Return

- If this is your first VAT period under MTD, check your VAT settings.

- On the navigation pane click VAT, then click VAT Return.

- To back up your data, click Back up and follow the on-screen prompts.

- Under the Date range, choose your VAT Return period then click Calculate VAT Return.

If there are any transactions before the date range not on a VAT return already, the Earlier unreconciled transactions window appears. To include these transactions, click Include. If you don't want to include them, click Ignore. - Check your VAT figures and post any required adjustments.

- Print your VAT Return reports.

- Click Reconcile VAT Return then click Yes.

Post the VAT transfer journal

- Complete the VAT transfer area as follows:

Date Enter the date for the VAT Transfer. Sales Tax Amount This is the amount from Box 1 on the VAT Return. You can amend this if required. Purchase Tax Amount This is the amount from Box 4 minus the amount from Box 2 on the VAT Return, you can amend this if required. - Click Post Journal.

Submit your VAT Return to HMRC

NOTE: If you'll submit these figures as part of a group VAT Return using the MTD Submissions Module, don't follow the steps below. Instead, click Close.

NOTE: If you'll submit these figures as part of a group VAT Return using the MTD Submissions Module, don't follow the steps below. Instead, click Close.

- Be in the Complete VAT Return window. If you've closed this window previously after reconciling the VAT return, to get back to this window double-click on the VAT Return.

- Click Submit online.

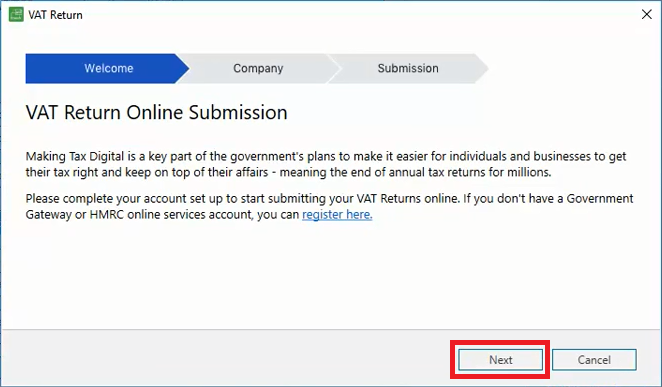

- Click Next.

- Check your company name and VAT Registration Number are correct, then click Next.

- In the Gov.uk window, scroll to the bottom and click Continue.

- Enter your Government Gateway ID and password. Click Sign-in.

- Click Continue then select a method to receive your access code.

- Click Continue and follow the on-screen prompts.

- In Access Code, enter the code you received, then click Continue.

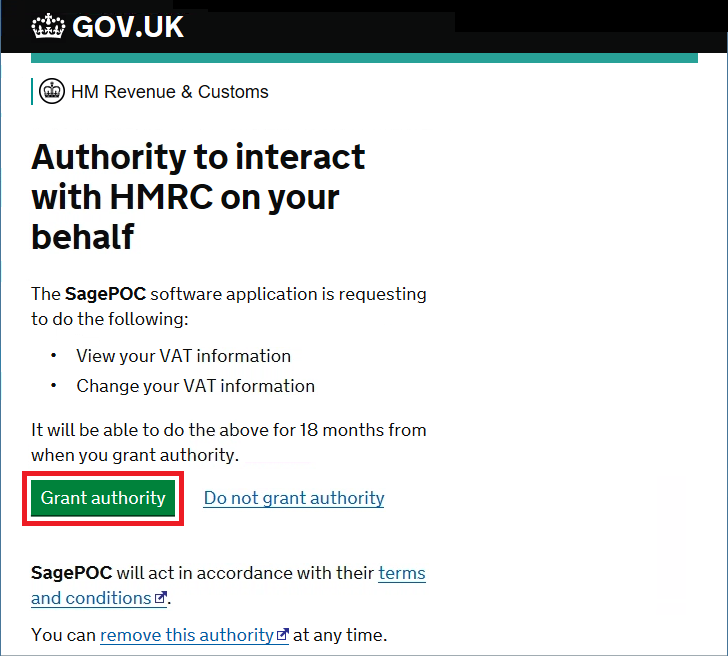

- Click Continue then click Grant Authority.

- Under Submit your period, in the drop-down click the obligation period you want to submit for.

TIP: More than one obligation period can show here, take care to choose the correct one. No obligation period showing?

TIP: More than one obligation period can show here, take care to choose the correct one. No obligation period showing? - Click the confirmation check box then click Submit to HMRC.

- When the successful submission window appears, click Close.

Getting a submission error?

- If required, to view a submission confirmation report, click Submission confirmation.

- If required, record your VAT bank payment however you have a payment set up with HMRC, then click Close.

NOTE: Sage doesn't automatically pay to or reclaim from HMRC. If you don't have a Direct Debit set up with HMRC you'll need to pay them via the HMRC website.

NOTE: Sage doesn't automatically pay to or reclaim from HMRC. If you don't have a Direct Debit set up with HMRC you'll need to pay them via the HMRC website.

Seeing a submission error?

We have a list of the most common submission errors and how to resolve them.

You can also search for the error message in our Help Centre to find out how to resolve it.

Upgrade your licence

Growing business? Add more companies, users, or employees to your licence with ease. Leave your details and we’ll be in touch.

Solution Properties

- Solution ID

- 200427112501646

- Last Modified Date

- Wed Mar 26 16:21:15 UTC 2025

- Attributes

- Product Details

- Views

- 0