Multi-currency invoicingBefore you can use multi-currency invoicing, you need to enable multi-currency transactions. This will allow you to set home currencies for your customers. It means new invoices default to that currency. You also need to choose which nominal accounts to record any bank charges, interest, exchange rate gains, or losses in. This ensures we can account for these on your VAT Return and other financial reports. Turn on multi-currency transactions- Go to Settings, then Business Settings and Financial settings.

- Select Currencies and select Enable foreign currency transactions.

- You can choose whether to apply Live exchange rates from the European Central bank (ECB). Here’s how it works when it’s turned on or off:

Live exchange rates turned on: Rates are automatically updated as they change. This means you will always have the latest rate. You don’t need to enter them manually.

Live exchange rates turned off: You’ll need to enter the latest rates manually. You’ll also need to make sure that you keep them updated with the latest exchange rates. - We have already created three currencies for you: Euro (EUR), Pound Sterling (GBP), and US Dollars (USD). You can’t delete your base currency, Pound Sterling (GBP), or a currency that’s in use.

- Add new currencies from the drop-down list as needed.

- To set up multi-currency nominal accounts, do the following:

- Check the Bank charges and interest nominal account is correct. By default, this is the same account used for your domestic invoices.

- Check the Exchange rate gains and losses ledger accounts are correct. The nominal accounts you choose for these options will show your gains or losses on reports. The standard chart of accounts in Sage Accounting includes the Exchange rate gains and losses nominal account. You can change it as needed.

- Select Save.

To use multi-currency invoicing, you need to set the default currency on your contacts. When you create an invoice, it uses the default currency set for that customer or supplier. Set currency settings on a contact- Go to Contacts, select either Customers or Suppliers.

- Select your customer or supplier from the list.

- Go to Options and Account details to view the currency.

- Select the pencil icon to edit.

- Select the new currency from the drop-down list. You won’t be able to do this if there are existing transactions for the contact. Instead, Create a customer contact for them with the new currency.

- Select Save.

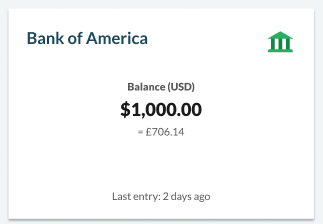

With multi-currency invoicing, you'll also need to add multi-currency bank accounts. You can use these for payments, revaluations (also called conversions), and other transactions. You can't use Multi-currency bank accounts with cash accounts. Adding them is the same as adding an account in your base currency. Select the currency you want in the Currency field. After you save it, the account will appear on the Banking page. The balance will show in the selected currency with your base currency underneath it.  TIP: Bank feeds are not available for bank accounts in other currencies. TIP: Bank feeds are not available for bank accounts in other currencies.

By adding a foreign bank account, you’re ready to process multi-currency transactions. Your sales and purchase documents will show the default currency of the contact. It will also show the exchange rate used. You can also toggle between the foreign currency and your base currency. How to create foreign currency transactions Once you select Record Payment you can choose which bank account you want to record the payment to. The selections will include your base currency accounts and an account that matches the foreign currency on the invoice.

When doing business with other countries, you may need to update transaction exchange rates. To do this, select the relevant bank account on the Banking page to open it. The Activity tab at the bottom of the page displays a list of transactions. Here you can review each transaction, including the amount received in both currencies.

Use the Currency view buttons to see your transactions in the currency of the account, or your base currency.

Revaluing involves changing the value of your base currency. This is due to fluctuations in the exchange rate. Complete this monthly or quarterly when needed.

Revalue an account: - Open the relevant bank account.

- Open the Revaluations tab and select Revalue this bank account.

- Select the date you want the balance to revalue on.

- The exchange rate automatically populates but you can change it.

- A loss or gain shows as a difference. For example, a balance of £100 revalued at a rate of 1.18 would show as a loss of -£2.25.

- The difference will post to the Exchange rate gains and losses ledger account. It will appear on your Profit and Loss Report as an overhead.

- Add a reference for audit purposes, for example month end revaluation.

- Select Revalue.

Once completed, details of all revaluations show in the revaluations tab. If you notice any errors, you can delete the entry and complete the revaluation again.

Recurring invoices You can't use Recurring invoices with foreign currency. Entering opening balances in other currencies Find out how to enter an opening balance for a bank account. Can’t connect to a bank feed Bank feeds are not yet available for bank accounts in other currencies. I need to check the revaluation details All revaluation details show in the Revaluations tab. If you notice any errors, you can delete the entry and complete the revaluation again. If you delete an entry, we recommend that you complete new revaluations on entries shown after this date. [BCB:299:UKI - Personal content block - Dane:ECB][BCB:302:UKI - Search override - Accounting UK:ECB] [BCB:276:UKI - hide back button:ECB] |