Create a journal entry

Summary

Description

A journal is for recording non-regular transactions. For example: the depreciation of a fixed asset or writing off a bad debt. You can also use journal entries to transfer values from one ledger account to another.

What you need to know

We use journals to move values between ledger accounts that won't affect:

- Customers

- Suppliers

- The bank account

This can be to correct errors or for some common accounting tasks such as:

- Depreciation of assets

- Payment of dividends

- Prepayments and accruals

Double-entry bookkeeping records every financial transaction twice: once as a debit and once as a credit. This practice ensures that the total debits always match the total credits, maintaining accurate records.

Resolution

Enter a journal

- Go to Adjustments then Journals. Select New Journal.

- Enter the date and a suitable Reference and Description. This helps you find and identify the journal later.

- Complete at least two lines from the following:

Details If required, enter details for the journal. Ledger Account * Select the nominal ledger account you want to use for the first line of the journal. Include on VAT Return? Choose whether you want to include this journal on your VAT Return. Debit If the journal line is for a debit value, enter the value here and leave the credit as 0.00. Credit If the journal line is for a credit value, enter the value here and leave the debit as 0.00. - Check the total value of credits and debits are the same. Select Save.

Quick tips

- Insert a new row above an existing journal entry line - hover over the

icon next to the relevant journal line. Select the Insert row above

icon next to the relevant journal line. Select the Insert row above button. When the blank entry line appears, enter the relevant journal information

button. When the blank entry line appears, enter the relevant journal information - Copy a row - hover over the

icon next to the relevant journal line, then click the Copy row

icon next to the relevant journal line, then click the Copy row button. When the duplicate entry line appears, edit the journal information as required

button. When the duplicate entry line appears, edit the journal information as required - Delete a row - hover over the

icon next to the relevant journal line you want to delete. Select the Remove row

icon next to the relevant journal line you want to delete. Select the Remove row button

button - Rearrange the order of the rows - hover over the

icon next to the journal line you want to move. Drag and drop the journal line into the required position. Repeat this step for any other journal lines you want to move until you’re happy with the ordering

icon next to the journal line you want to move. Drag and drop the journal line into the required position. Repeat this step for any other journal lines you want to move until you’re happy with the ordering

Attach files

You can add attachments here too. For example, a copy of a receipt. Select the Attachment  button then select Upload files.

button then select Upload files.

Find out more about how to Add attachments to your transactions.

Using control accounts with journals

We create and use default ledger accounts known as control accounts. They automatically record transaction details to ensure accuracy and reduce errors.

For example: You save a sales invoice. Automatically record the total value of the invoice against the Trade Debtors ledger account, and record the VAT against the VAT on Sales ledger account.

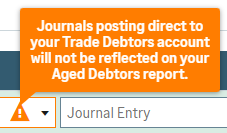

When selecting a control account while entering a journal, we’ll display a warning message. This allows you to verify that you’ve chosen the correct ledger account and ensures accurate journal entries.

Examples of warning messages

| Ledger Account | Warning |

| Trade Debtors | Journals posting directly to your Trade Debtors aren't on your Aged Debtors Reports. |

| Trade Creditors | Journals posting directly to your Trade Creditors aren't on your Aged Creditors Reports. |

| VAT on Sales | Journals posting to VAT on Sales are only on your VAT Return if you select the ‘include on VAT Return’ option. |

| VAT on Purchases | Journals posting to VAT on Purchases are only on your VAT Return if you select the ‘include on VAT Return’ option. |

| VAT Liability | Journals posting to the VAT Liability aren't on your VAT Return. |

| VAT on Sales – Holding Account | Journals posting to the VAT on Sales Holding aren't on your VAT Return. |

| VAT on Purchases – Holding Account | Journals posting to the VAT on Purchases Holding aren't on your VAT Return. |

Learning with Sage

To learn more about this and other key tasks, sign up for our FREE bookkeeping course at Sage University here.

Related Solutions

Solution Properties

- Solution ID

- 222001000100721

- Last Modified Date

- Sun Mar 23 20:20:38 UTC 2025

- Views

- 0