Summary

Resolution

NOTE: What is Plaid? Plaid provides most of our bank feeds. Plaid is a trusted third party that handles millions of bank feeds worldwide. If Plaid will handle your feed, you'll give permission to connect to their services as part of the process detailed below.

NOTE: What is Plaid? Plaid provides most of our bank feeds. Plaid is a trusted third party that handles millions of bank feeds worldwide. If Plaid will handle your feed, you'll give permission to connect to their services as part of the process detailed below.

Before you start

- To check you have everything you need, and your bank is compatible, ensure you complete the preparation tasks for bank feeds

Set up bank feeds

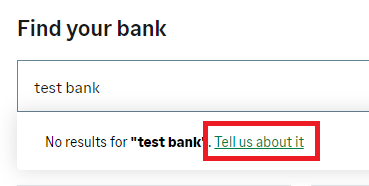

- In the Bank Feeds window, select your Country, then search for your bank in the Find your bank field. You can also choose it from the list under Or choose from these banks.

- After clicking your bank name, click Continue then follow the on-screen instructions to connect to your bank. These steps are unique to your bank and can include entering your online banking credentials.

- In the Download starting from field, select the date you want to start downloading transactions from.

- Click Continue.

NOTE: The start date must be in the last 90 days and can be sooner, depending on your bank.

NOTE: The start date must be in the last 90 days and can be sooner, depending on your bank.

A window appears either confirming the connection, or with further authorisation steps from your bank.

- To complete the setup, click Finish.

You've now set up your Bank feed connection

Next steps

If your bank authorises the connection immediately during setup, start using bank feeds now. Your bank can require a physical authorisation form, if so, allow up to 10 working days.

You can start using bank feeds once your connection activates.

Bank Feeds Security Statement:

Security is of the highest importance regarding our bank connectivity. The Sage functionality that connects to your bank goes through annual external security certification to the latest security industry standards including ISO 27001 and SOC 2 certification.

For UK bank connections Sage and its providers use Open Banking which is the latest and most secure method to connect to a bank.

For EU Banks our connections to banks use PSD2 which is the latest and most secure method to connect to a European bank implemented by the European Banking Authority (EBA).

Both methods involve banks providing connectivity in a standardised format to the latest industry standard.

The information captured from your bank and passed through to Sage contains transaction information which includes the amount, date, type, and a description of the transactions, as well as account details which include: account name, type, account number, and balance. As you select the bank to connect to you will be presented with the information that will be captured as part of the connection as well as the terms and conditions of using the connection ahead of proceeding.

Are you outgrowing Sage 50 Accounts?

Sage Intacct is designed for companies that have more complex requirements.Find out more about how Sage Intacct can benefit your growing business.

Register your interest and we'll get in touch.