UK - Default tax codes

Summary

The default tax codes used in Sage 50 Accounts v27.0 and below.

Description

If you're VAT registered, the tax code for each transaction in Sage 50 Accounts determines the VAT Return box affected.

Your software version

This article relates to Sage 50 Accounts v27.0 and below. For other versions, see our Sage 50 Accounts v27.1 and above article.

Using the right tax code ensures your VAT Return is correct.

Find the right tax code to use

We have some articles to help you find the correct tax code to use:

- Identify Which tax code should I use?

- View examples of Tax codes to use for popular goods and services

Default tax codes in your software

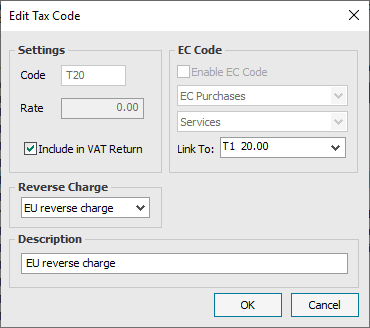

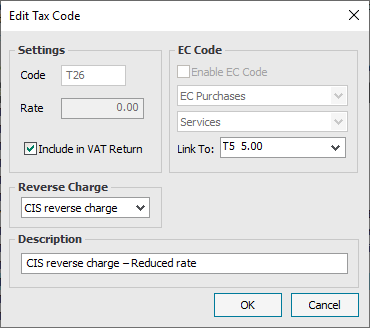

To check the default tax codes in your software:

- Click Settings then click Configuration then click Tax Codes.

- Select the Code then click Edit.

TIP: If this article doesn't list the tax code, you can create or amend a tax code.

TIP: If this article doesn't list the tax code, you can create or amend a tax code.

Select the tax code for more information:

| This article offers general guidance only. While accurate at the time of publication, it may not suit your specific needs. We make no express or implied warranties. For tailored advice, consult a professional. For VAT, customs, or duties queries, contact HMRC on 0300 200 3700 or visit www.hmrc.gov.uk. We accept no liability for any loss from using this content. VAT or tax codes shown reflect default software settings and may differ in your setup. |

Upgrade your licence

Growing business? Add more companies, users, or employees to your licence with ease. Leave your details and we’ll be in touch.

Solution Properties

- Solution ID

- 201222101733580

- Last Modified Date

- Wed Dec 11 15:26:00 UTC 2024

- Attributes

-

Product DetailsModules: Tax

Modules: VAT

- Views

- 0