Summary

The default tax codes used in Sage 50 Accounts v27.0 and below.

Description

If you're VAT registered, the tax code for each transaction in Sage 50 Accounts determines the VAT Return box affected.

Your software version

This article relates to Sage 50 Accounts v27.0 and below. For other versions, see our Sage 50 Accounts v27.1 and above article.

Using the right tax code ensures your VAT Return is correct.

Find the right tax code to use

We have some articles to help you find the correct tax code to use:

- Identify Which tax code should I use?

- View examples of Tax codes to use for popular goods and services

Default tax codes in your software

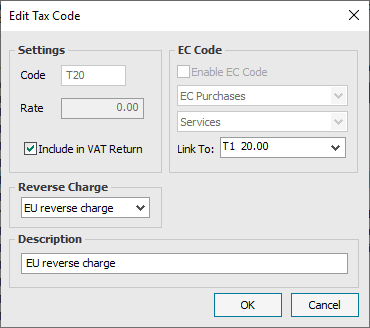

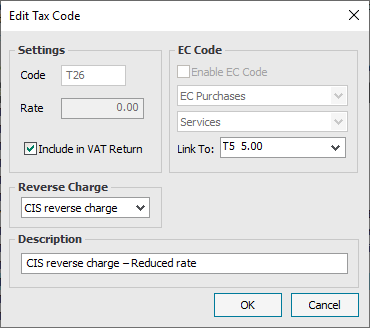

To check the default tax codes in your software:

- Click Settings then click Configuration then click Tax Codes.

- Select the Code then click Edit.

TIP: If this article doesn't list the tax code, you can create or amend a tax code.

TIP: If this article doesn't list the tax code, you can create or amend a tax code.

Select the tax code for more information:

| This article provides general rather than specific guidance to assist all of our customers. We always do our best to make sure that the information is correct but as it's general guidance, no guarantees can be made concerning its suitability for your particular needs. The information is valid at the time of publishing and is provided without any warranty of any kind, express or implied. You should take professional advice if you require specific guidance on your individual circumstances, for example to ensure that the results obtained from using our software comply with statutory or regulatory requirements. For VAT, customs and excise and duties enquiries you should call the HM Revenue and Customs (HMRC) National Advice Service Helpline on 0300 200 3700, contact your local HMRC office or visit their website at www.hmrc.gov.uk In no event will we be liable to you for any direct, indirect, consequential or incidental loss or damage arising out of or in connection with your use of the information provided. The VAT or tax codes used in this article are based on the default or recommended codes set up in the software. These may be different in your software. |

Upgrading your licence

Need a little more room? To add extra companies, users, employees or more to your software licence, leave your details and we'll be in touch.