Summary

The Chart of Accounts in Sage 50 Accounts: what it is, what it contains, and how to edit it.

Description

What is the Chart of Accounts?

Running management reports in Sage 50 Accounts categorises your nominal accounts. This allows you to analyse your income, expenditure, assets, liabilities, and capital to assess your business performance. The Chart of Accounts lists all nominal accounts and assigns them to these categories. You can have multiple Chart of Accounts.

What are nominal accounts?

Nominal accounts track your sales and purchases, such as bank charges, petrol, or sales. Each account has a unique code, which you can customise to fit your numbering scheme.When entering a transaction in Sage 50 Accounts, assign the relevant nominal code, such as for a sales invoice or bank payment.

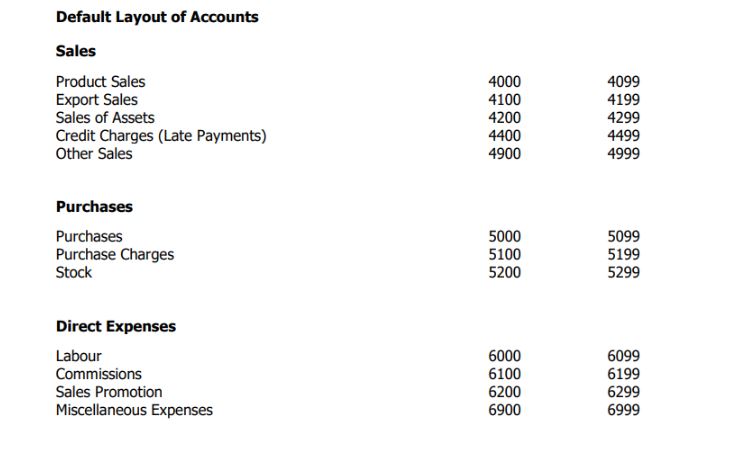

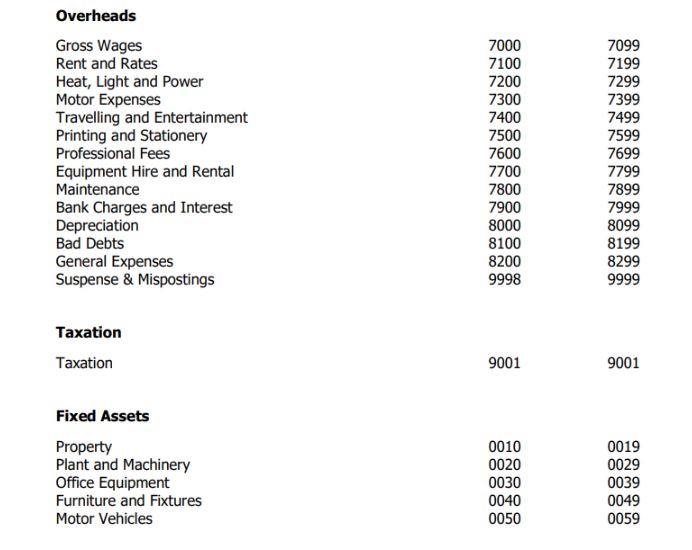

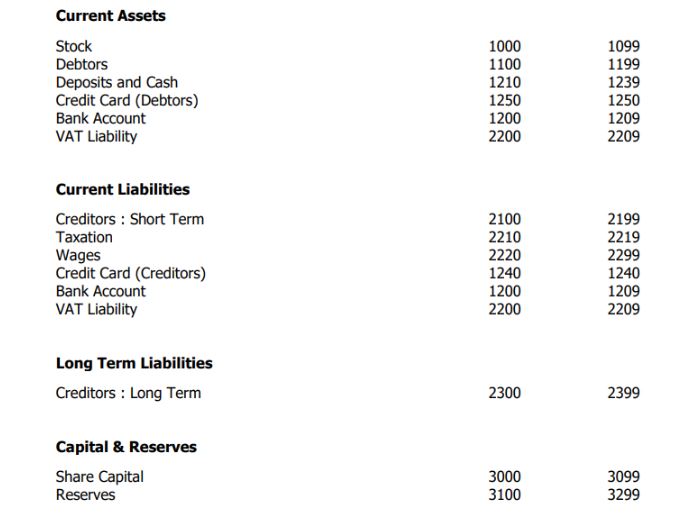

Default Layout of Accounts

When setting up your company in Sage 50 Accounts, your nominal accounts and Chart of Accounts are based on the selected business type. Business types include sole trader, partnership, limited company, or charity.What does the Chart of Accounts consist of?

The chart of accounts has two sections - Profit and Loss and Balance Sheet.

What can I do to the Chart of Accounts?

If necessary you can: