This is an optional scheme to help you report and pay all EU VAT through a single return instead of having to register and pay VAT in each country you sell to. This applies to sales to individuals or business who are based in the EU and who are not VAT registered. The schemes are called: - The One Stop Shop

- The Import One Stop - applies to businesses based in Great Britain only

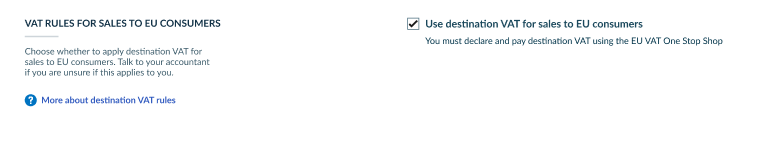

For the One Stop Shop schemes, you use Destination VAT. Instead of charging VAT at the usual UK rate (or home rate), you charge VAT at the rate where your customer lives. For example, if as a UK business you sell goods to a customer in France, you charge VAT at the rate applicable in France. Visit our business legislation hub to see how this may affect your business. Use the One Stop Shop (OSS) to report and pay EU VAT on services to EU consumers which attract destination VAT. For a full list of services visit the European Commission website (opens in new tab). The OSS can also be used to report and pay EU VAT in relation to intra-community distance sales of goods which are still relevant for businesses residing in Northern Ireland with an XI VAT registration. On 1 July the EU also abolished distance selling thresholds and replaced them with a single EU wide €10,000 (£8,818) threshold. The Import One Stop Shop (IOSS) For Great Britain only. The IOSS can be used to report and pay EU VAT on goods imported into the EU from outside the EU destined for EU consumers with a consignment value of £135 (€150) or less. If you use IOSS you will need to charge destination VAT at point of sale. This means there is no import VAT upon arrival in the EU, making it easier for your end customer. How to register Destination VAT in Sage Accounting Destination VAT settings and reports are available in Sage Accounting. Apply destination VAT in VAT settings Choose whether to apply destination VAT rules to EU consumers. We’ll automatically add ledger account 2206 VAT on Destination Sales so you can report separately on the total amount you have charged for destination VAT.

For a full list of services that attract destination VAT visit the European Commission website (opens in new tab). Apply destination VAT to sales invoices Once you add an EU consumer (not VAT registered) and an OSS service to an invoice, the destination VAT rate will automatically calculate. Northern Ireland only Once you add an EU consumer (not VAT registered) and a product to an invoice, the destination VAT rate will automatically calculate. Great Britain only Once you add an EU consumer (not VAT registered) and a product to an invoice, select Apply £135 (€150) consignment rules to charge destination VAT for goods with a value of £135 (€150) or less.

Recurring invoices and destination VAT Once you apply destination VAT in financial settings, recurring invoices to EU customers will be paused and will show a status of Action Required. Create a copy of the invoice and the destination VAT rate will automatically calculate. Delete the original invoice. Run the destination VAT report The OSS Sales Analysis report in Reporting will show all sales where destination VAT has been charged. This will help you to complete your One Stop Shop VAT Return. Invoicing with destination VAT Before you start If you need to charge destination VAT, check that you have added: - Destination VAT rules in financial settings

- An EU customer who is not VAT-registered

Create a sales invoice for goods under £135 -

Go to Sales, and select New Invoice. -

In the Customer field, select your EU customer from the list, or type the customer name. If the customer is not a saved contact, select Add a customer to create a record for them. -

Select Apply £135 (€150) consignment rules to charge destination VAT on goods with a total consignment value of £135 (€150) or less.  TIP: For this option to show, check that you selected: TIP: For this option to show, check that you selected:

- Destination VAT rules in financial settings

- An EU customer that is not VAT registered

-

Enter a Description. -

In EU Goods/Services select Goods (and related services) to apply destination VAT rules. The destination VAT rate will automatically calculate. Repeat steps 4 and 5 on a new line for as many items as you need to add to your invoice. The total value of goods must not exceed £135 (€150).  TIP: If you need to add a service item that does not have destination VAT rules, you must create a separate invoice. This is because invoices cannot contain a mixture of home VAT rules and destination VAT rules. TIP: If you need to add a service item that does not have destination VAT rules, you must create a separate invoice. This is because invoices cannot contain a mixture of home VAT rules and destination VAT rules.

-

Select Save. The VAT Return The VAT element on destination VAT sales is excluded from your VAT Return. You need to report this on your IOSS VAT Return through the IOSS system. Create a sales invoice for OSS services - Go to Sales, and select New Invoice.

- In the Customer field, select your EU customer from the list, or type the customer name. If the customer is not a saved contact, select Add a customer to create a record for them.

- Enter a Description.

-

TIP: To calculate destination VAT on the invoice, check that you selected: TIP: To calculate destination VAT on the invoice, check that you selected:

Repeat steps 3 and 4 on a new line for as many items as you need to add to your invoice. -

Select Save. The VAT Return The VAT element on destination VAT sales is excluded from your VAT Return. You need to report this on your OSS VAT Return through the OSS system. Businesses in Northern Ireland Create a sales invoice for goods - Go to Sales, and select New Invoice.

- In the Customer field, select your EU customer from the list, or type the customer name. If the customer is not a saved contact, select Add a customer to create a record for them.

- Enter a Description.

-

In EU Goods/Services select Goods (and related services) to apply destination VAT rules. The destination VAT rate will automatically be calculated.  TIP: To calculate destination VAT on the invoice, check that you selected: TIP: To calculate destination VAT on the invoice, check that you selected:

- Destination VAT rules in financial settings

- An EU customer that is not VAT registered

Repeat steps 3 and 4 on a new line for as many items as you need to add to your invoice. -

Select Save. The VAT Return The VAT element on destination VAT sales is excluded from your VAT Return. You need to report this on your OSS VAT Return through the OSS system. Create a sales invoice for OSS services - Go to Sales, and select New Invoice.

- In the Customer field, select your EU customer from the list, or type the customer name. If the customer is not a saved contact, select Add a customer to create a record for them.

- Enter a Description.

-

In EU Goods/Services select Services (standalone) to apply destination VAT rules.  TIP: To calculate destination VAT on the invoice, check that you selected: TIP: To calculate destination VAT on the invoice, check that you selected:

- Destination VAT rules in financial settings

- OSS Services for the service item

- An EU customer that is not VAT registered

Repeat steps 3 and 4 on a new line for as many items as you need to add to your invoice. -

Select Save. The VAT Return The VAT element on destination VAT sales is excluded from your VAT Return. You need to report this on your OSS VAT Return through the OSS system. [BCB:299:UKI - Personal content block - Dane:ECB]

[BCB:300:UKI - Search override - Start UK:ECB]

[BCB:276:UKI - hide back button:ECB] |