If you're VAT registered, the tax code for each transaction in Sage 50 Accounts determines the VAT Return box affected. Your software version This article relates to Sage 50 Accounts v27.0 and below. For other versions, see our Sage 50 Accounts v27.1 and above article. Using the right tax code ensures your VAT Return is correct.

Find the right tax code to use We have some articles to help you find the correct tax code to use:

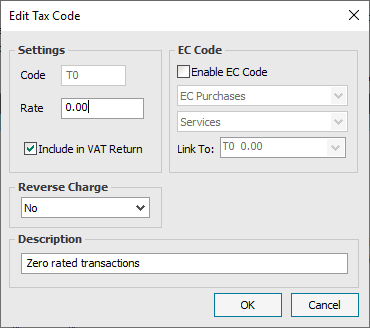

Default tax codes in your software To check the default tax codes in your software: - Click Settings then click Configuration then click Tax Codes.

- Select the Code then click Edit.

TIP: If this article doesn't list the tax code, you can create or amend a tax code. TIP: If this article doesn't list the tax code, you can create or amend a tax code.

Select the tax code for more information: ▼ T0 - Zero rated transactions On the VAT Return - Sale - Net amount affects box 6. VAT amount N/A

- Purchase - Net amount affects box 7. VAT amount N/A

Configuration

▼ T2 - Exempt transactions On the VAT Return - Sale - Net amount affects box 6. VAT amount N/A

- Purchase - Net amount affects box 7. VAT amount N/A

Configuration

▼ T5 - Lower Rate - Currently 5% On the VAT Return - Sales - Net amount affects box 6. VAT amount affects box 1

- Purchases - Net amount affects box 7. VAT amount affects box 4

Configuration

▼ T20 - EU reverse charge On the VAT Return - Sales - Net amount affects box 6. VAT amount N/A

- Purchases - Net amount affects box 7. VAT amount affects boxes 1 and 4. This is notional VAT which cancels itself out

Configuration

▼ T21 - CIS reverse charge - Standard rate On the VAT Return - Sales - Net amount affects box 6. VAT amount N/A

- Purchases - Net amount affects box 7. VAT amount affects boxes 1 and 4. This is notional VAT which cancels itself out

Configuration

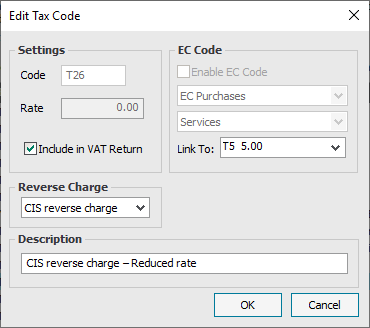

▼ T26 - CIS reverse charge - Reduced rate On the VAT Return - Sales - Net amount affects box 6. VAT amount N/A

- Purchases - Net amount affects box 7. VAT amount affects boxes 1 and 4. This is notional VAT which cancels itself out

Configuration

[BCB:44:Accounts VAT disclaimer:ECB]

[BCB:19:UK - Sales message :ECB] [BCB:97:Limitless - 50 Accounts - VAT:ECB] |