If you are using Group Submissions, where several sets of data are pulled together and submitted under one VAT Registration number, you must download the Sage 200 MTD Submission Module and refer to Sage 200 - Making Tax Digital version compatibility. To enable this a specific file is required to be copied to their PC which will allow submissions to the updated HMRC gateway. Key dates for when submissions under the new MTD regulations should begin can be found here. - Download the UseOnlineVATPilot.xml file from here

- Copy the file to C:\Users\name.surname\AppData\Local\Sage200

NOTE: This path does not include the 'Sage200' folder by default and it must be created. NOTE: This path does not include the 'Sage200' folder by default and it must be created.

- Edit the UseOnlineVATPilot.xml to point to the relevant companies (specify the company ID).

- This information can be found by logging in to Sage 200 System Administration and selecting the Companies option from the left hand menu. There is a column headed Company ID and each company listed will have its own ID.

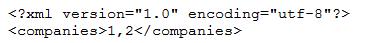

The UseOnlineVATPilot.xml file can be edited in Notepad, and should look something like this:

In this example, the second line has been modified to enable MTD for company IDs 1 and 2. - If you change your company and make it redundant, or keep it for reference as a working backup, it is likely you will have created a new working company. This new company will have a new company ID. e.g. Company IDs are now 4 and 5. You will need to amend the xml file to show the following:-

- In Nominal Ledger Settings, tick the Enable online VAT Submissions box on the VAT Submissions tab, if required.

Under this setting, it will now display Making Tax Digital: Pending. Once the first VAT return has been produced under MTD, this will change to Enabled.

NOTE: If you do not see the Making Tax Digital line, on the VAT Submissions tab, or it does not display the word Pending, check that your Country Code, within Accounting System Manager, Settings then Company Details is set to GB - Great Britain. NOTE: If you do not see the Making Tax Digital line, on the VAT Submissions tab, or it does not display the word Pending, check that your Country Code, within Accounting System Manager, Settings then Company Details is set to GB - Great Britain.

Your base currency must also be set to Pounds Sterling and ISO is set to GBP on the Settings tab of Currencies & Exchange Rates, in the same area of Accounting System Manager.

The customer will now be able to use the new HMRC gateway to submit their VAT returns.  CAUTION: As the program is hard-coded to look for this specific filename, renaming it will make the file invalid. CAUTION: As the program is hard-coded to look for this specific filename, renaming it will make the file invalid.

[BCB:19:UK - Sales message :ECB] |