| T0 - Zero-rated sales and purchase of goods for resale | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | N/A |

| Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | N/A |

| T1 - Standard-rated sales and purchase of goods for resale - currently 23% | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | Appears in box T1 and VAT charged on suppliers of Goods and Services box |

| Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | Appears in box T2 |

| T2 - Exempt sales and purchase of goods for resale | | | |

| VAT | N/A | |

| Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | N/A |

| T3 - Reduced rate sales and purchase of goods for resale - currently 13.5% | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | Appears in box T1 and VAT charged on supplies of Goods and Services box |

| Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | Appears in box T2 |

| T4 - Sales of goods to VAT-registered customers in EC | Sales | Net | Appears in box E1 and Total value of sales, excluding VAT box |

| VAT | N/A |

| T5 - Exempt import of goods from suppliers in EC | Purchases | Net | Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT | N/A |

| T6 - Exempt import of goods from suppliers outside EC | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | N/A |

| T7 - Zero-rated purchases of goods from suppliers in EC | Purchases | Net | Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT | N/A |

| T8 - Standard-rated purchases of goods from suppliers in EC | Purchases | Net | Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT | Appears in boxes T1 and T2 and VAT due on intra-EU acquisitions box |

| T9 - Non-Vatable Tax Code | Transactions using T9 don't appear on your VAT Return |

| T10 - Zero-rated purchase of goods for non-resale | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | N/A |

| T11 - Standard-rated purchase of goods for non-resale | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | Appears in box T2 |

| T12 - Exempt purchase of goods for non-resale | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | N/A |

| T13 - Reduced rated purchase of goods for non-resale | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | Appears in box T2 |

| T14 - Zero-rated export of goods to customers outside EC | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | N/A |

| T15 - Exempt import of goods from suppliers in EC | Purchases | Net | Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT | N/A |

| T16 - Exempt import of goods from suppliers outside EC | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | N/A |

| T17 - Zero-rated purchases of goods from suppliers in EC | Purchases | Net | Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT | N/A |

| T18 - Standard-rated purchases of goods from suppliers in EC | Purchases | Net | Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT | Appears in boxes T1 and T2 and VAT due on intra-EU acquisitions box |

| T19 - Zero-rated purchases of goods from suppliers outside EC with resale | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | N/A |

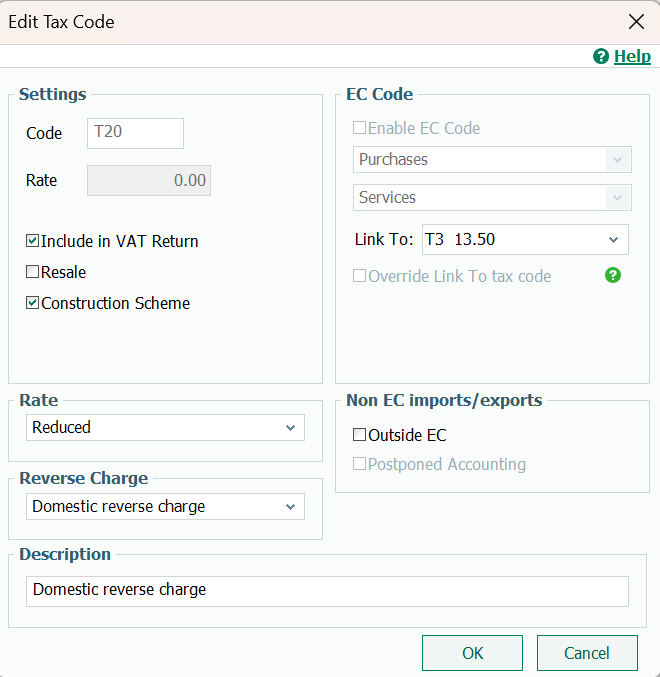

| T20 - Reverse charge including Relevant Contracts Tax (RCT) ▼ View image

NOTE: Construction scheme checkbox added in v33 and above. NOTE: Construction scheme checkbox added in v33 and above.

NOTE: Construction scheme checkbox added in v33. This is selected by default. NOTE: Construction scheme checkbox added in v33. This is selected by default.

| Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | Appears in boxes T1 and T2 and VAT charged on supplies of Goods & Services box |

| T21 - Zero-rated purchases of goods from suppliers outside EC without resale | Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | N/A |

| T22 - Sales of services to VAT-registered customers in EC | Sales | Net | Appears in box ES1 and Total value of sales, excluding VAT |

| VAT | N/A |

| T23 - Zero-rated purchases of services from suppliers in EC | Purchases | Net | Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT | N/A |

| T24 - Standard-rated purchases of services from suppliers in EC | Purchases | Net | Appears in box ES2, Total value of sales, excluding VAT and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T1 and T2 and VAT charged on supplies of Goods & Services box |

| T25 - Reduced rated purchases of goods from suppliers in EC | Purchases | Net | Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT | Appears in boxes T1 and T2 and VAT due on intra-EU acquisitions box |

| T26 - Reduced rated purchases of goods from suppliers in EC | Purchases | Net | Appears in box E2 and Total value of purchases, excluding VAT box |

| VAT | Appears in boxes T1 and T2 and VAT due on intra-EU acquisitions box |

| T27 - Second reduced rate sales/purchase of goods for resale | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | Appears in box T1 and VAT charged on supplies of Goods and Services box |

| Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | Appears in box T2 |

| T28 - Second reduced rate sales/purchase of goods for non-resale | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | Appears in box T1 and VAT charged on supplies of Goods and Services box |

| Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | Appears in box T2 |

| T29 - Second reduced rated purchases of goods from EC suppliers | Purchases | Net | Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T2 and VAT due on intra-EU acquisitions |

| T30 - Second reduced rated purchases of goods from EC suppliers | Purchases | Net | Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T2 and VAT due on intra-EU acquisitions |

| T31 - Livestock rate sales and purchase of goods for resale | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | Appears in box T1 and VAT charged on supplies of Goods and Services box |

| Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | Appears in box T2 |

| T32 - Livestock rate sales and purchase of goods for non-resale | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | Appears in box T1 and VAT charged on supplies of Goods and Services box |

| Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | Appears in box T2 |

| T33 - Livestock-rated purchases of goods from EC suppliers | Purchases | Net | Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T2 and VAT due on intra-EU acquisitions |

| T34 - Livestock-rated purchases of goods from EC suppliers | Purchases | Net | Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T2 and VAT due on intra-EU acquisitions |

| T35 - Flat rate compensation sales/purchase of goods for resale | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | Appears in box T1 and VAT charged on supplies of Goods and Services box |

| Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | Appears in box T2 |

| T36 - Flat rate compensation sales/purchase of goods non-resale | Sales | Net | Appears in Total value of sales, excluding VAT box |

| VAT | Appears in box T1 and VAT charged on supplies of Goods and Services box |

| Purchases | Net | Appears in Total value of purchases, excluding VAT box |

| VAT | Appears in box T2 |

| T37 - Flat rate compensation purchases of goods from EC suppliers | Purchases | Net | Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T2 and VAT due on intra-EU acquisitions |

| T38 - Flat rate compensation purchases of goods from EC suppliers | Purchases | Net | Appears in box ES2 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T2 and VAT due on intra-EU acquisitions |

| T39 - Standard rate ROW import (Resale) Postponed VAT | Purchases | Net | Appears in PA1 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T1, T2, and VAT due on intra-EU acquisitions and postponed VAT |

| T40 - Standard rate ROW import (Non-resale) Postponed VAT | Purchases | Net | Appears in PA1 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T1, T2, and VAT due on intra-EU acquisitions and postponed VAT |

| T41 - Zero rate ROW import (Resale) Postponed VAT | Purchases | Net | Appears in PA1 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T1, T2, and VAT due on intra-EU acquisitions and postponed VAT |

| T42 - Zero rate ROW import (Non-resale) Postponed VAT | Purchases | Net | Appears in PA1 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T1, T2, and VAT due on intra-EU acquisitions and postponed VAT |

| T43 - Reduced rate ROW import (Resale) Postponed VAT | Purchases | Net | Appears in PA1 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T1, T2, and VAT due on intra-EU acquisitions and postponed VAT |

| T44 - Reduced rate ROW import (Non-resale) Postponed VAT | Purchases | Net | Appears in PA1 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T1, T2, and VAT due on intra-EU acquisitions and postponed VAT |

| T45 - Second reduced rate ROW import (Resale) Postponed VAT | Purchases | Net | Appears in PA1 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T1, T2, and VAT due on intra-EU acquisitions and postponed VAT |

| T46 - Second reduced rate ROW import (Non-resale) Postponed VAT | Purchases | Net | Appears in PA1 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T1, T2, and VAT due on intra-EU acquisitions and postponed VAT |

| T47 - Livestock rate ROW import (Resale) Postponed VAT | Purchases | Net | Appears in PA1 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T1, T2, and VAT due on intra-EU acquisitions and postponed VAT |

| T48 - Livestock rate ROW import (Non-resale) Postponed VAT | Purchases | Net | Appears in PA1 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T1, T2, and VAT due on intra-EU acquisitions and postponed VAT |

| T49 - Flat rate compensation ROW import (Resale) Postponed VAT | Purchases | Net | Appears in PA1 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T1, T2, and VAT due on intra-EU acquisitions and postponed VAT |

| T50 - Flat rate compensation ROW import (Non-resale) Postponed VAT | Purchases | Net | Appears in PA1 and Total value of purchases, excluding VAT |

| VAT | Appears in boxes T1, T2, and VAT due on intra-EU acquisitions and postponed VAT |

| T51 - Purchase of Services ROW (resale) - Self Accounting VAT | Purchases | Net | Appears in Box 4 on VAT return |

| VAT | Appears in Box1, T1 and T2 for reverse charge |

| T52 - Purchase of Services ROW (Non-resale) - Self Accounting VAT | Purchases | Net | Appears in Box 4 on VAT return |

| VAT | Appears in Box1, T1 and T2 for reverse charge |